Automate manual processes to accelerate Sicredi’s Digital Transformation

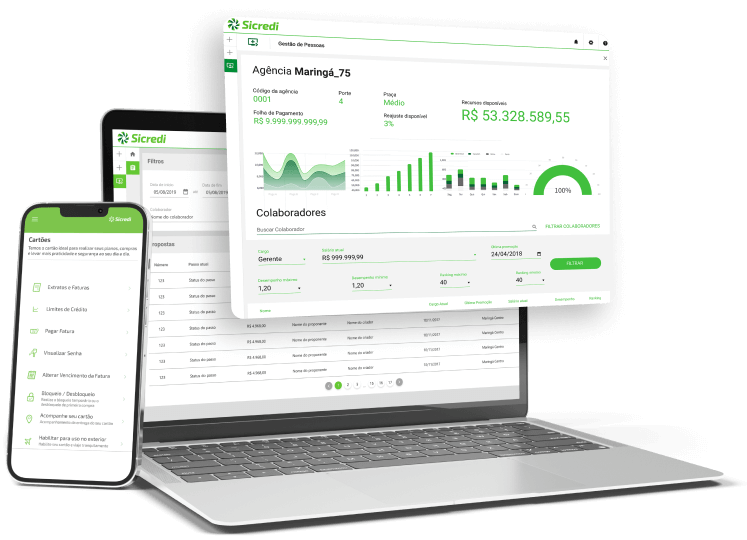

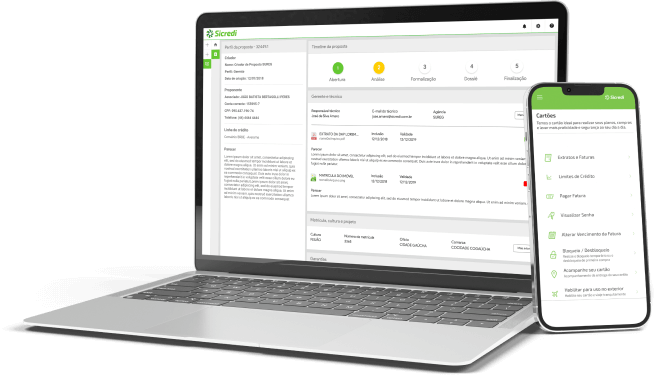

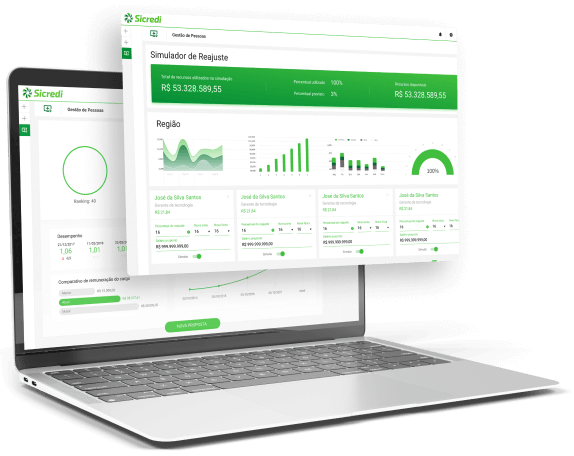

Customized Software Development for three different areas of the cooperative

Agile, scalable, and secure

Sicredi’s Digital Transformation

With UDS Software Development, Sicredi achieved its goal of improving the customer experience and optimizing processes on a large scale.

Need to develop software that will transform your business?

Talk to our experts:

Technology transforms.

We create transformation.